Describe the features of a fixed-income security.

A fixed-income security is a type of investment that pays regular interest payments to the investor and returns the principal amount (the original amount invested) at a specified maturity date. Here are some of its features:

1. Credit Risk: This is the risk that the issuer (the entity that borrowed the money) will not be able to make full and timely payments of interest or repay the principal amount. The higher the credit risk, the higher the interest rate the investor would expect.

2. Credit Quality: This refers to the likelihood that the issuer will be able to repay the debt. It is determined by factors such as the issuer's financial health, the source of repayment, and the legal terms of the bond.

3. Indenture: This is a legal contract that outlines the terms and conditions of the bond, including the interest rate, the schedule of interest payments, and the maturity date.

4. Covenants: These are legally enforceable terms that the issuer agrees to at the time of issuance. They can either require the issuer to take certain actions or prohibit the issuer from doing certain things.

5. Coupon Rate: This is the interest rate that the issuer agrees to pay the investor. It can be fixed or variable. In a fixed-rate bond, the interest rate remains the same throughout the life of the bond. In a variable-rate bond, the interest rate can change based on market conditions.

6. Maturity: This is the date when the issuer has to repay the principal amount to the investor. The time remaining until the maturity date is called the tenor.

7. Principal: This is the original amount of money that the investor lends to the issuer. It is also the amount that the issuer agrees to repay the investor at the maturity date.

For example, if you buy a bond with a principal of $1000, a coupon rate of 5%, and a maturity of 10 years, you will receive $50 (5% of $1000) every year for 10 years. At the end of the 10 years, you will get your $1000 back.

Describe the contents of a bond indenture and contrast affirmative

A bond indenture is a legal contract between the issuer of a bond (the borrower) and the bondholder (the lender). It outlines the characteristics of the bond, such as its maturity date, interest rate, and principal amount. It also specifies the obligations of the issuer and the rights of the bondholder.

In the bond indenture, there are two types of covenants or promises made by the issuer: affirmative and negative covenants.

Affirmative covenants are things that the issuer promises to do. For example, the issuer may promise to maintain certain financial ratios, such as a specific debt-to-equity ratio, or to provide regular financial statements to the bondholders.

Negative covenants, on the other hand, are things that the issuer promises not to do. These could include not taking on additional debt beyond a certain level, not selling certain assets without the bondholders' approval, or not merging with another company without meeting certain conditions.

These covenants are designed to protect the bondholders' interests by ensuring that the issuer maintains a certain level of financial health and does not engage in activities that could jeopardize its ability to repay the bond.

For example, consider a company that issues a bond to raise money for a new project. An affirmative covenant in the bond indenture might require the company to maintain a certain level of cash reserves. A negative covenant might prohibit the company from taking on additional debt that could make it harder for the company to repay the bond.

In summary, the bond indenture serves as a legal contract that outlines the terms of the bond and includes covenants that protect the bondholders by governing the issuer's actions.

Describe how annual coupon amount for a fixed-rate bond is calculated.

The annual coupon amount for a fixed-rate bond is calculated based on the bond's face value and its coupon rate. The face value is the amount the bondholder will receive when the bond matures, and the coupon rate is the interest rate that the bond issuer promises to pay the bondholder annually.

For example, if a bond has a face value of $1,000 and a coupon rate of 5%, the annual coupon payment would be $50 ($1,000 * 5%). This means that every year, the bondholder will receive $50 from the bond issuer until the bond matures, at which point the bondholder will also receive the bond's face value of $1,000.

In simple terms, if you buy a bond, you are lending money to the issuer of the bond. In return, the issuer promises to pay you a certain amount of interest every year (the annual coupon payment) and to return the money you lent (the face value) when the bond matures

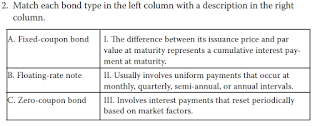

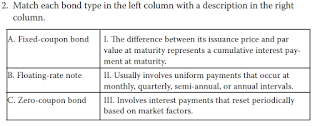

Question

A. Fixed-coupon bond - II. Usually involves uniform payments that occur at monthly, quarterly, semi-annual, or annual intervals. This means that the bond pays a fixed interest rate to the bondholder at regular intervals (monthly, quarterly, etc.).

B. Floating-rate note - III. Involves interest payments that reset periodically based on market factors. This means that the interest rate on the bond can change over time, based on changes in the market interest rate.

C. Zero-coupon bond - I. The difference between its issuance price and par value at maturity represents a cumulative interest payment at maturity. This means that the bond does not pay regular interest payments, but is sold at a discount to its face value and pays the full face value at maturity.

Which of the following is the appropriate order of claims in liquidation, by

type of bond, in order of highest to lowest?

The appropriate order of claims in liquidation, by type of bond, from highest to lowest is: Senior secured, senior unsecured, junior . This means that in the event of a company's bankruptcy, the first to be paid are the senior secured bondholders, followed by senior unsecured bondholders, and lastly, junior bondholders.

Senior secured bondholders have the highest priority because their bonds are backed by specific assets of the company. If the company goes bankrupt, these bondholders have a claim to these specific assets.

Senior unsecured bondholders are next in line. Their bonds are not backed by specific assets, but they still have a higher claim than junior bondholders.

Junior bondholders are last in line. They are the most at risk of losing their investment if the company goes bankrupt, as they are only paid after all other bondholders have been paid.

This order is important as it affects the risk and potential return of the bond. The higher the risk (i.e., the lower the priority in case of bankruptcy), the higher the potential return needs to be to attract investors

Explain in simple English., with an example, the purpose of a pari passu clause in a bond indenture.

A pari passu clause in a bond indenture is a provision that ensures all debts are treated equally, without any preference or priority for one over another. This means that if a company goes bankrupt, all of its debt holders will be paid back at the same rate, without any one debt holder getting paid before another.

For example, let's say a company has two types of bonds outstanding: Bond A and Bond B. If the company goes bankrupt and has to liquidate its assets to pay back its debts, a pari passu clause would ensure that the holders of Bond A and Bond B are paid back at the same rate. Neither group of bondholders would get preferential treatment over the other.

This clause is important because it provides a level of protection for bondholders, ensuring that they will be treated fairly in the event of a company's bankruptcy.